- Home

- Results & Studies

- TV/CTV advertising revenues could rise by 5% by 2024, to €3.8 billion

TV/CTV advertising revenues could rise by 5% by 2024, to €3.8 billion

In 2024, CTV should benefit from a double wind of change: growth in very high-speed broadband connections (64% of French people were fibre subscribers at the end of September 2023, 13 points more than in spring 2021) and the rise in smart TV (54%) or other OTT equipment (30%) should continue to drive the use of the various streaming platforms. A more favorable environment, due in particular to the men's Euro football tournament and the Paris Olympic games, and strong competition between the various components of this universe (launch of TF1+ and acceleration of the platformisation of the other historical audiovisual groups, launch of Max and arrival of advertising on Prime Video, premiumization of AVoD and FAST, etc.) mean that we can expect robust growth in advertising revenues for TV/CTV as a whole (+5%). ), according to the AVoD Market Report conducted by NPA Conseil and Médiamétrie, we can expect robust growth in advertising revenues for TV and CTV combined (+5%), with a total close to €3.8 billion (after €3.65 billion in 2022 and €3.6 billion in 2023).

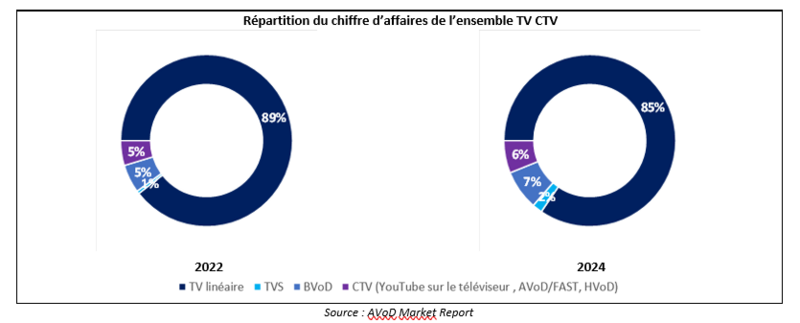

In 2024, all the components of the TV / CTV package should see positive growth in their advertising revenues, but not at the same rate, and of course each component will not carry the same weight. Traditional linear TV spot campaigns should be back in the black, but with limited growth (+2%). At the other end of the scale, HVoD (advertising revenues from SVoD platforms) and segmented advertising (TVS) should be the most dynamic (up to +200% for HVoD)... but from much more limited bases. In the end, the share of linear television should remain close to 85%. And, more broadly, broadcasters' share (including the contribution from TVS and BVoD) of 95%. AVoD and FAST are expected to bring in nearly €30m in revenues, but will still have less than a 1% market share. And it is YouTube that will attract the bulk of CTV's revenues.

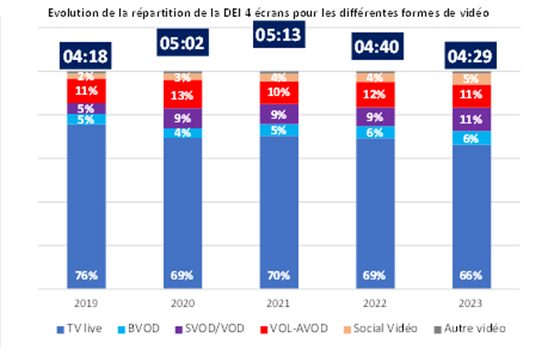

The "battle for attention" aimed at confirming this monetization potential promises to be all the more intense as the amount of time spent by the French watching video appears to be nearing its ceiling.

The AVoD Market Report analyses the driving forces behind a war of movement in which the various competitors will be seeking to capitalize on their target audiences and develop their competitive advantages.

The different video streaming services and their target audiences

A war of movement announced for 2024

In the wake of the launch of TF1+ on 8 January 2024, the incumbent players should reap the benefits of clarified priorities in their transition from replay to BVoD, and in their stated desire to offer genuine "destination platforms" by capitalizing on extended rights windows and pursuing hyperdistribution strategies in all OTT environments.

SVoD services still have significant potential, despite the fact that more than 40% of the French population do not yet subscribe to any service, and more than one in four only subscribe to one. But with the financial markets still keeping a close eye on them, streamers will have to optimise the mix of today's subscription revenues (derived from premium offers at higher prices) and tomorrow's advertising revenue prospects (the development of the subscriber base for ad-supported packages), while keeping investment in content and marketing expenditure under control.

The arrival of advertising on Prime Video (broadcast by default to all subscribers from day one) could represent a game changer in the monetization of SVoD uses. However, this will not come into effect until later this year, so its effects will be felt mainly in 2025.

YouTube and the other video-sharing services have replicated the usual television formats in their advertising offers on CTV (notably the 30-second spot that cannot be switched off). But optimising their monetization also means increasing the share of long formats in viewing time. The launch in Europe - and particularly in France - of a range of FAST channels inspired by the one launched in the United States in early 2023 could contribute to this, although the Group has not yet confirmed any such plans.

In addition to YouTube, AVoD and FAST could find powerful distribution boosters if Amazon develops one of its free streaming platforms (Freevee or Fire TV Channels) for the French market and/or if other ISPs (Free, Orange or SFR) follow in the footsteps of Bouygues Telecom and its agreement with Pluto TV. In 2024, the premiumisation of the offering will continue the trend already identified in the first parts of the AVoD Market Report, with the expected arrival on Samsung TV Plus of around ten Altice channels (including BFM TV, RMC Story and RMC Découverte).

But these growing links between AVoD/FAST and DTT (presence of channel packages in BVoD offerings, AVoD and FAST platforms taken over by DTT groups, etc.) could also reduce the space available for independent development.

The new audience measurement, a new currency for 2025

The positions won in 2024 will also determine the ability of the various video streaming segments to prepare for the arrival of the convergent audience measurement being prepared by Médiamétrie and the introduction of a new exchange currency at the beginning of 2025, depending on the outcome of joint work by the SNPTV, the Union des Marques and UDECAM.

Please click on the icon to download the comprehensive press release.

Download

des médias

edition

definitions